Best Online Bookkeeping Services: Accounting Services Simplify Your Business

Best Online Bookkeeping Services: Accounting Services Simplify Your Business

Blog Article

Startup Bookkeeping Packages: Managing Your Little Business'S Financial Records Is Important For Its Success

Selecting The Right Bookkeeping System

Navigating the labyrinth of accounting systems can feel like a challenging mission, especially for the budding business owner. It's not practically crunching numbers; it's about finding a rhythm that resonates with your organization's special heartbeat. Think about it this method: would a master chef utilize a blunt butter knife to julienne veggies? Of course not! Likewise, your accounting system needs to be the sharpest tool in your financial arsenal.

Manual vs. Digital: The Age-Old Dispute

For some, the reassuring rustle of paper ledgers and the methodical click of a pen use a sense of control. This standard approach, typically involving spreadsheets and even physical journals, can be incredibly intuitive for those with very low transaction volumes. It belongs to tending a little garden by hand-- every plant gets specific attention. As your company blooms, the sheer volume of invoices, receipts, and payments can rapidly change that tranquil garden into an overgrown jungle. Errors multiply, reconciliation ends up being a Herculean task, and unexpectedly, your precious time is swallowed by administrative quicksand. Is this really the best usage of a small company owner's day?

The Digital Leap: Cloud-Based Solutions

The digital age has ushered in a variety of cloud-based bookkeeping solutions, revolutionizing how small companies handle their finances. These platforms use unparalleled benefit, allowing you to access your financial data from essentially anywhere, at any time. It's like having a financial assistant living get more info in your pocket, constantly prepared to update ledgers or generate reports. This ease of access is a game-changer for business owners who are constantly on the move, handling numerous responsibilities. These systems often automate tedious tasks, from categorizing expenses to reconciling bank accounts, considerably decreasing the potential for human error. Imagine the peace of mind understanding your books are always up-to-date, all set for tax season or an impromptu monetary review.

When considering a digital option, consider the following:

- What is your convenience level with technology?

- The number of transactions do you process monthly?

- Do you require to integrate with other organization tools, such as point-of-sale systems or payroll software?

- What level of financial reporting do you need?

- How important is automated invoicing and expenditure tracking?

Scalability and Assistance

A crucial, yet typically neglected, aspect of selecting a bookkeeping system is its scalability. What works for a solo endeavor today may give in the weight of a growing business tomorrow. Your picked system ought to be able to progress with your service, accommodating increased transaction volumes, extra users, and more complicated monetary requirements. Think long-term. Will this system still serve you well when your company uses 5 people, or fifty? In addition, consider the schedule of client assistance. When you come across a snag, having easily available support can be a lifesaver, changing moments of disappointment into swift resolutions. Remember, the ideal bookkeeping for small business system is not just a tool; it's a tactical partner in your journey to financial clarity and sustained growth. It ought to streamline, not make complex, your monetary life.

Recording Financial Deals Precisely

The bedrock of any growing small company? Remarkable record-keeping. Think of your monetary transactions as the heartbeat of your business; if it avoids a beat, or even worse, flatlines, you're in for a rough ride. Numerous entrepreneurs, frequently overflowing with passion for their product and services, find themselves adrift in a sea of invoices and invoices. Ever heard the one about the shoebox complete of crumpled documents? It's not simply a cliché, it's a typical truth for many fledgling services, resulting in a scramble when tax season looms or when seeking financing. What good is a fantastic concept if its financial underpinnings are shaky?

The Peril of Unreconciled Accounts

One of the most significant obstacles small companies encounter is the gorge in between their bank declarations and their internal records. This discrepancy, often subtle in the beginning, can snowball into a huge job, obscuring the true monetary health of the service. Picture attempting to navigate a dense fog-- that's what unreconciled accounts seem like. Forgetting to log a little, repeating subscription, or miscategorizing a big purchase, can shake off your whole system. The ripple impact extends beyond mere hassle, impacting everything from capital projections to precise profit and loss statements. Do you really know where every dollar goes, or where it comes from?

To prevent this common mistake, think about these professional insights:

- Daily Discipline: Make it a non-negotiable routine to log deals daily, or at the extremely least, every other day. This isn't about being compulsive; it's about preventing a mountain from forming out of molehills.

- Classification is King: Establish a consistent, clear chart of accounts from the beginning. This often neglected step is critical. Are those workplace provides an administrative expenditure or a marketing cost? Clarity here conserves immense headaches later on.

- Digital Tool Usage: While a spreadsheet might suffice for the very tiniest operations, investing in dedicated accounting software can be a game-changer. These platforms automate much of the information entry and reconciliation, substantially minimizing human error. Believe of it as having a determined assistant committed solely to your financial resources.

- Routine Reconciliation: Do not wait up until month-end. Reconcile your bank and charge card declarations with your internal records weekly. This proactive approach permits you to catch mistakes or inconsistencies while they are still little and easily rectifiable. A fast check now saves hours of investigator work later on.

Comprehending the nuances of financial transaction recording isn't practically compliance; it has to do with empowerment. It gives you the clarity to make informed choices, identify costs patterns, and identify locations for growth or expense decrease. Without accurate information, your company choices are, at best, educated guesses. With it, you possess an effective compass directing you through the often-turbulent waters of entrepreneurship. Remember, every penny tells a story; guarantee yours is a true and precise narrative.

Handling Payroll and Expenditures: The Quiet Revenue Drain

Ever seem like you're continuously chasing after invoices, playing investigator with bank declarations, and wondering where all your hard-earned cash disappears? For many small company owners, the apparently simple job of managing payroll and expenditures becomes an overwelming labyrinth, a quiet earnings drain that siphons away precious resources. This isn't simply about stabilizing books; it's about safeguarding your monetary health. Consider it like a leaky faucet: individually, each drip seems irrelevant, however gradually, it clears the whole tank. The biggest difficulty often isn't the complex computations, but the large volume and varied nature of transactions, making it surprisingly simple for things to slip through the cracks. Are you carefully tracking every organization expense, or are some falling by the wayside, costing you potential tax deductions?

One typical risk is the commingling of individual and business funds. It's a habit numerous brand-new entrepreneurs fall under, a blurred line that makes accurate expenditure tracking an outright nightmare. Picture attempting to discuss to an auditor why your grocery bill from last Tuesday is linked with your workplace supply purchases. This apparently innocuous practice can lead to considerable headaches down the line, not simply with tax authorities however also in comprehending your true success. How can you assess the health of your organization if you don't have a clear image of its financial inputs and outputs? Different checking account and credit cards are non-negotiable. This isn't just a recommendation; it's basic to sound bookkeeping for little organization. Additionally, think about the often-overlooked area of staff member expenditure compensations. Without a robust system, these can rapidly end up being a source of aggravation and inaccuracies. Do your employees understand the proper treatment for sending expenditures? Is there a clear approval procedure in place?

Streamlining Your Expenditure & & Payroll Processes

The service depends on effective systems and a proactive state of mind. For payroll, consider the benefits of direct deposit over paper checks; it decreases administrative concern and offers a clear audit trail. Ensure you understand the nuances of classifying staff members versus independent specialists; misclassification can lead to hefty charges. For expenditures, the power of digital tools can not be overemphasized. Ditch the shoebox loaded with crumpled invoices! Mobile apps developed for cost tracking allow you to snap a picture of an invoice, categorize it, and even attach it to a particular project or client, all in real-time. This not only conserves you time but likewise ensures accuracy and makes year-end tax preparation significantly less overwhelming. What's more, executing a clear expenditure policy for your team, outlining what is reimbursable and what isn't, can avoid disputes and misunderstandings before they even occur. A distinct policy functions as a compass, guiding everyone towards compliant and efficient spending.

- Utilize committed organization bank accounts and credit cards.

- Implement digital expense tracking software for real-time capture.

- Automate payroll processes to minimize mistakes and save time.

- Establish a clear, written expense reimbursement policy for staff members.

- Routinely reconcile bank statements with your accounting records.

Keep in mind the adage, "What gets measured gets managed." Without precise cost tracking and meticulous payroll management, you're essentially flying blind. You won't truly know your revenue margins, nor will you be able to make educated choices about development or cost-cutting. This isn't practically compliance; it has to do with tactical financial insight. Are you genuinely optimizing your reductions? Are there spending patterns you're uninformed of that could be enhanced? The time invested in establishing robust systems for managing payroll and expenditures will pay dividends, releasing you to focus on what you do best: growing your business.

Generating Financial Reports: The Unsung Hero of Small Service Accounting

Ever seemed like you're navigating a dense fog, trying to make vital service decisions without a clear view? That's exactly what happens when you neglect the power of well-generated monetary reports. Lots of small company owners, understandably swamped with day-to-day operations, view these reports as simple compliance documents. What if I informed you they are, in reality, your most potent compass?

The Real Obstacle: Disorganized Data

The main stumbling block for a lot of isn't the act of generating the report itself, however the chaotic, scattered data that precedes it. Imagine attempting to bake a cake with ingredients scattered across the kitchen, some missing, others expired. That's the truth for numerous who haven't welcomed precise bookkeeping from the first day. Transactions are logged haphazardly, invoices go missing, and bank reconciliations become Herculean tasks. This disarray undoubtedly trickles down, making the production of accurate financial statements an aggravating, error-prone undertaking. How can you genuinely comprehend your company's health if the very details you're relying on is flawed?

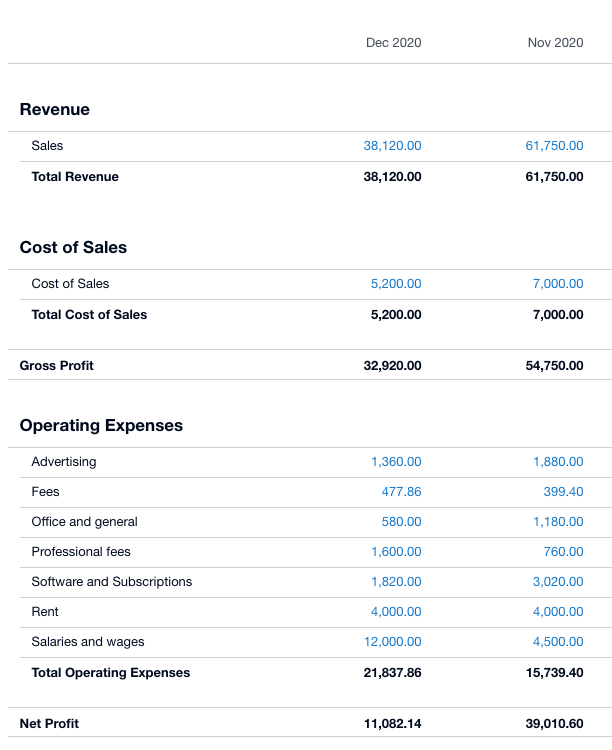

- Revenue and Loss Declaration (P&L): This isn't just about what you made and invested. It tells a story. Is your gross revenue margin diminishing? Are operating costs spiraling out of control? An eager eye on your P&L can expose if your pricing strategy is effective or if you're overspending on marketing that isn't yielding returns.

- Balance Sheet: A photo of your financial position at a specific minute. It details your possessions, liabilities, and equity. Think about it as your service's net worth. Are your accounts receivable growing too big, suggesting collection concerns? Is your financial obligation manageable? This report offers important insights into your liquidity and solvency.

- Cash Circulation Statement: Frequently ignored, yet arguably the most important. A lucrative business can still go under if it runs out of money. This report tracks cash can be found in and going out, revealing if you have enough liquid funds to cover your obligations. It addresses the sixty-four-thousand-dollar question: where did the cash go?

Specialist Tips for Flawless Reporting

To produce meaningful monetary reports, cultivate a habit of daily or weekly information entry. Don't let deals accumulate; it's like trying to bail out a sinking ship with a thimble. Reconcile your savings account and credit cards consistently. This isn't almost capturing errors; it has to do with making sure every cent is represented, supplying the pristine data needed for accurate reporting. Consider implementing cloud-based accounting software. These platforms automate much of the information entry and reconciliation, drastically minimizing manual mistakes and saving vital time. They likewise provide customizable report design templates, making the generation process practically uncomplicated. Keep in mind, the clearer your information, the sharper your insights. What story do your numbers inform about your service's future?

Report this page